|

Michael Serwa, originally from Eastern Europe, is a life coach. He isn't an ordinary run-of-the-mill life coach, however, he's at the top of the coaching game. He really knows how to get to the soul of a problem. He's gained massive popularity since the launch of his book From Good to Amazing and is so in demand that people now pay up to 5-figures to get onto his calendar. I was honoured to be interviewed by him. If you have any questions at all about my business or starting your own, please ask them under his video. Watch here:

3 Comments

When I first arrived at my boarding school I was three weeks late because I had started off at another school before my parents decided they preferred this one. To cut a long story short, friends had been made and penetrating the existing cliques was a task I could not be bothered with. Being in the middle of nowhere I set myself up with a rigorous study schedule (for an 11 year-old) which resulted in me reading and doing homework for at least four hours every single day from the beginning of term. From a marketing perspective, what does this mean? If you create a brand that has multi-level sensory appeal, that is, it has a look, a feel, a smell, a tag-line or even a jingle, even when one or several of those elements are absent people are reminded of your brand. And if they like it, they want it. A McDonald’s fanatic merely has to hear the McDonald’s whistle to start craving a Big Mac. The theory of neuroplasticity is not limited to marketing - reading between the lines I realised that it applies to learning things in general. For instance, when I first went to high school in 1995 I found school a bit of a challenge. I wasn't failing, far from it, but I was a borderline B/A student. I am currently re-reading Brainfluence by Roger Dooley. It is hands-down the best neuro-marketing book I have ever read and all other books simply don't math up. Anyway, on a second read or watch of something you always learn something new and on this occasion one theory really caught my attention. The theory is technically called "neuroplasticity" and was first proposed by Sigmund Freud then was later elaborated upon by a Canadian psychologist called Donald Hebb; it was finally summarised in six words by the neuroscientist Carla Shatz as: “Neurons that fire together wire together.” This theory just helped me understand some of the things I have observed in my life but never really understood. Lessons finished at 3pm and I was in the library 3.30 to 5.30pm as standard and then I went to dinner. Prep time was 6.30-8.30pm and I studied then too. I started doing homework during break time and lunch time so all four hours could be spent studying.

At first I used to find recall a little challenging but the more I studied, the easier it got and the more I enjoyed it. With maths, I quickly learnt that when you practice the problems in preparation for an exam instead of just reading the solutions sets in the book you really came to understand the topic so that's what I did. I became so good at memorising that I didn't even realise the point at which I stopped memorising and started understanding things. It appeared that the more I knew the more I could relate seemingly unrelated topics especially in maths. By the time I got to university I didn't think learning was hard anymore - in fact - by comparison, I can say I found the University of Cambridge easier than high school! But this is where it gets interesting. Throughout my life I have taken an interest in being coached and having a mentor and I think this theory of neuroplasticity applies to coaching very well. I am not into feel-good motivational coaching that makes you feel good about yourself without any practical steps. Feeling good about myself is not something I have a problem with and the few times that I might have that issue, I can just call one of my doting younger sisters. When it comes to practical action-based coaching you learn so much information in such a short space of time and with that synaptic impulses must be flying all over the place in your brain. By being coached and learning from someone else's experience you cut the learning time and get to your goals a lot faster than if you had to make every mistake by yourself. Having all the knowledge sitting in your brain at the same time creates a multiplier effect. It’s a case of 1 + 1 = 3. A lot of people don't take much interest in coaching and learning once they leave the formal education system but I think those that do achieve a lot more, faster. The first step in educating yourself is in reading books that feed your brain. The next step is to either take courses with like-minded people or form voluntary groups and societies with people that you know you will learn from. In doing so you will achieve any goal, financial or otherwise, more rapidly than taking the trial and error route. "I never cease to be amazed at the power of the coaching process to draw out the skills or talent that was previously hidden within an individual, and which invariably finds a way to solve a problem previously thought unsolvable." John Russell For inspirational quotes follow @Getting2Wealthy on twitter.  Check out Toia's Natural Hair Regimen Check out Toia's Natural Hair Regimen Making money via elance.com is tough if you live in a developed country because the cost of living is so high. Fact: people want to hire someone in the US or the UK because there are no language barriers and they generally expect a better quality finish; however, when they compare our rates to those of much cheaper and equally qualified people in Asia, they can't justify selecting a UK- or US-based person. I stumbled upon a guy who made almost $24k on elance in a month by analyzing it and coming up with a winning formula: Hacking Elance – The Step by Step Guide to How I Made $23,700 in 4 Weeks He's mixed race/black so it can't be said that it wouldn't work for a black person. I am very impressed by the fact that he really took time to analyze the platform and came up with his own winning formula before jumping in. The beauty of using videos to pitch is that people get to:

Any way, I only use elance to hire, if I ever want to make money via the platform I will definitely re-read Daniel DiPiazza's tips in Hacking Elance – The Step by Step Guide to How I Made $23,700 in 4 Weeks

We've only just admitted to each other that whilst we enjoyed the culinary birthday I had planned we did very much feel out of place amongst these Bentley wielding, Michelin Star eating, designer clothes wearing hot shots. I'll take you to the start...  ...back in May I was walking around Blackheath village with my cousin Cecillia when I told her I was at a loss with regards to what to do for my awesome husband's 30th birthday. She knew I'd bought him a couple of cook books for our first anniversary and he'd recently very successfully taken up the challenge of learning to cook; consequently, she suggested taking him out somewhere really special, somewhere known for it's culinary delights. I totally agreed - enter: the world of Michelin Stars. I had very limited knowledge about Michelin Stars but I knew they meant "great quality food" and the more Michelin stars you had the posher your nosh. 3 michelin stars are the most you can have and the UK has only four such restaurants - the whole of the US has 11 such restaurants, this demonstrates just how very rare the accolade is. I won't take you through all the deliberating I went through but ultimately we ended up going to:

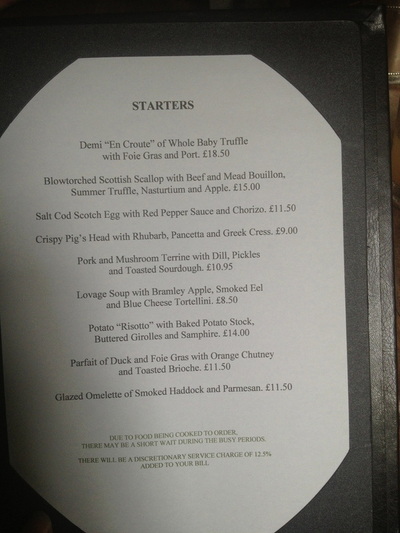

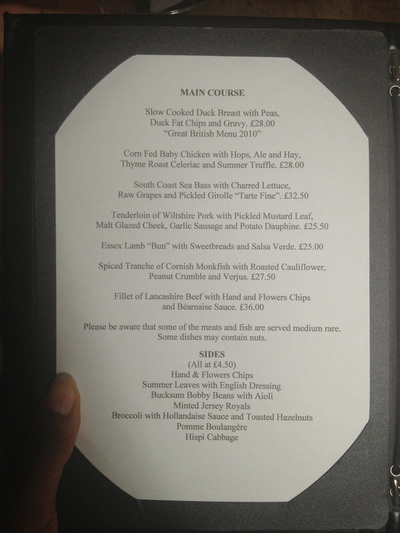

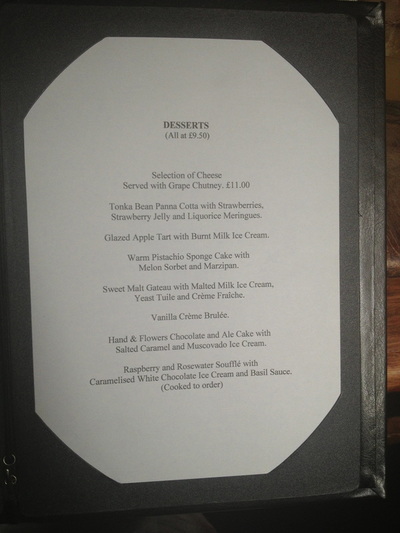

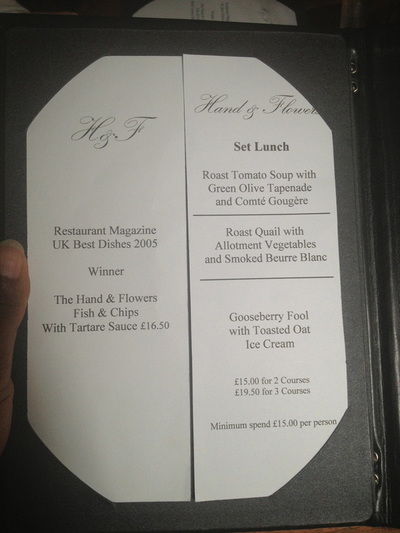

Then the next morning, I told him. "Remember that video we watched?" "Yeah?" Harry said. "Well, we're going to The Hand & Flowers for lunch!" He smiled, "Phew, I thought you'd booked a cookery course and I wasn't up for doing any work!" I continued, "We're also going to the 3 Michelin Star Fat Duck for dinner!" "Two places in one day?" "Yep." He looked happy but worried. I knew it was probably because he thought I was wasting money." We then watched the video below which incidentally was a continuation of the series of Masterchef, The Professionals, that we had watched the night before: After watching these three videos we were officially both excited. I gave Harry his first birthday present: a white shirt that I had personally designed on iTailor. The Hand & Flowers Of all the places we went to this is the one I felt least out of place in. The desserts we had here were my favourite of all three restaurants because they were more hearty. The prices are also A LOT more reasonable so we'll be going back here. Just to give you an idea of how popular the place is, the restaurant was booked up for weekends for about 12 months in advance! They also have 4 rooms to let but could I get one? Oh no, not 3 months in advance, as at May every weekend until February 2014 was fully booked! The food in pictures: After lunch at The Hand & Flowers we wanted to take a walk but were actually quite tired so we decided to drive to our cottage for a nap. Clematis Cottage, Bray

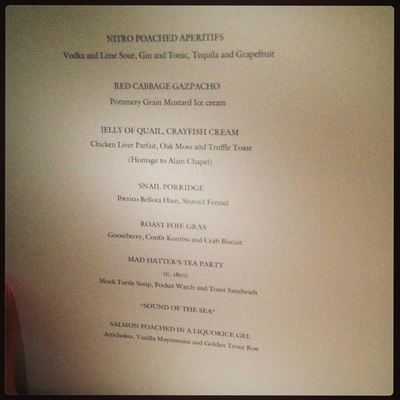

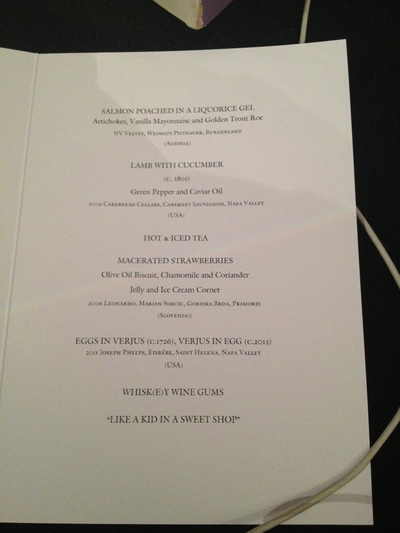

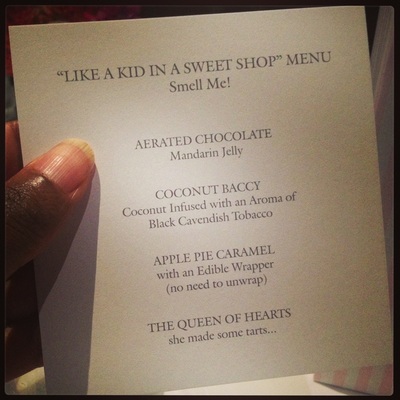

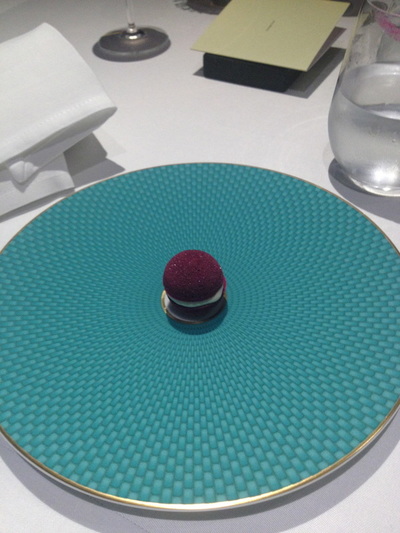

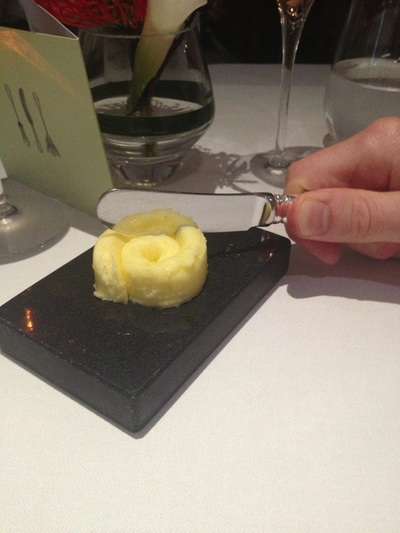

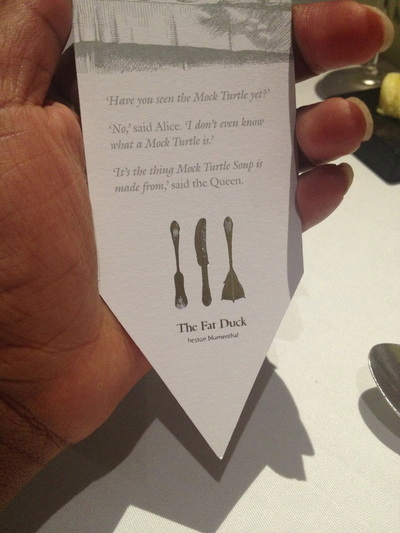

When we got to Clematis Cottage I gave Harry his second birthday present: another custom designed shirt from iTailor, this time in blue. After hanging out and posting some pictures to instagram we slept for a while before getting ready for dinner at the 3 Michelin Starred The Fat Duck; our first experience of dining at this level. The Fat Duck The Fat Duck's 14 course taster menu is something else. The food comes along with a fair amount of abracadabra and without someone there to explain it, you wouldn't have a clue what you were eating. It goes without saying that the staff were all extremely polite and professional. Also, although the food was extremely complex it didn't matter who you asked, they knew exactly what it was and how it was made. Bookings at The Fat Duck are almost impossible. They open up for booking at 09.55 a.m. exactly two months in advance. I had a friend on hand trying to get a booking from that time alongside my attempts. I failed, she succeeded after about 3 hours of trying! The Food: I wasn't quite sure if I was "full" after the Fat Duck; there was space there for more but I decided it was because the food was so tasty rather than my stomach not being satiated. Anyway, the whole experience had lasted over three and a half hours so we were both tired. At this point, Harry didn't even know about Le Gavroche. The next morning after having breakfast, going for a walk and showering I presented Harry with his third and final birthday present: another iTailor shirt in a different shade of blue to the second, "One for each decade you've lived. " I said. "Not one for every year I've lived?" he joked! I also told him we were going to Le Gavroche. He looked unhappy: "That's too much," he said, "I've had enough of fine dining. I feel guilty now." To be honest, I was feeling guilty too by this point. I did think the indulgence of the day before was plenty to keep us going for months to come but I knew tonight was extra special, tonight his mum, dad, sister and brother-in-law would be there. I knew this would definitely make a difference to him and I wanted to tell him but I couldn't. We spent the day walking along the Thames in Marlow. Some of the houses along the riverbank were insane. One private residence had a garden so large there were two gardeners on motorised mowers tending to the lawn! It could not have been a hotel because there would have been hotel patrons in the yard enjoying the river views on what was a gorgeous summer day but it was grand enough. Le Gavroche We left Marlow at a good time and arrived in the Mayfair area 30 minutes before the dinner booking but there was a problem: the "surprise entourage" were running late. I had to stall a very annoyed Harry for 30 minutes...Harry's sister Whatsapped us a picture complaining how late she was working and I thought, nice touch, but... ...in the end we still arrived about a minute before our group. In fact they were metres behind us and I thought Harry would see them. I pushed him across the road to Le Gavroche and I lied that I needed the loo to buy a little more time for the crew to get to the restaurant. The toilet was downstairs near the still empty dining area. Luckily Harry used the loo too and took his time, as usual. When he came out of the toilet I wasn't sure how everything would go down, I had always imagined us arriving at the table and the family whispering "surprise" - I don't think you shout in these types of places! I was still thinking about what to do when the waitress said: "Would you like to be shown to the table or do you want to go to the bar for a while?" I don't even know if she knew the conundrum I was in so I said bar and Harry fortunately agreed immediately. He still looked a little unhappy (although that could have been because he'd lost his wallet earlier that morning!) The family were at the top of the stairs at the bar and I said to Harry, "Do you want to sit there?" Pointing to an empty seat next to his dad. He looked up not recognising the four people sitting there for an instant and then he realised he was looking at his fabulous fam. We hadn't seen them for a month. He grinned the happiest grin I had seen all day and we were shown to our table. The food was fabulous, however, the crowning moment of that event happened when Michel Roux Jr of the Roux chef dynasty came to our table. I had made a request via a waitress but didn't dare to hope. He posed in a picture with us AND signed autographs. We were all star struck and indeed very happy. It was a beautiful evening.

I enjoyed these two days but I am actually happy to return to my normal life. For us, being in these places was a real treat, something very special - but, what do the have mores do to get that "I'm having a treat" feeling? For us, dinner out at the restaurant chain Giraffe is a treat so this culinary adventure was a SUPER TREAT. I am left with one desire now: to take a journey through the thoughts of a Have More to see the relative contentment of their life and lifestyle, I'm just curious. Anyhow, to a great life with Harry and many more years. Do you know the difference between the two? It’s an important difference.

If you own a business that business continues to make money whether or not you are there. If you own a job, yes, you’re still in control but once you go off on holiday your revenue stops coming in. I learnt this way of thinking when I read Rich Dad, Poor Dad by Robert Kiyosaki in 2007. He says a lot of professionals like doctors and lawyers make this mistake when they start their own practice because they do all the work themselves. If you want to actually own a business you need to thinking of a structure that gives you revenue even when you’re on holiday, e.g. a legal partnership where partners get a share of profits in addition to bringing in clients. If you own a service business, you can franchise your business when it gets large enough. If you make a physical product you can eventually find a manufacturer for mass production - there are only so many "widgets" you can make yourself. My whole life set up in a way that my current hard work will continue to pay dividends for a long time to come – even while I sleep! Through Black Girl – Getting To Wealthy I help other people do the same:  I love to visit antique shops and junk yards because you find amazing furniture at fantastic prices. I found this table at a place called Aladdin's Cave in London. It cost £20 (just over $30). I thought it was a bargain. The base of this stool is beautiful! I would have liked to paint the bottom a creamy colour and the top parma gray (by Farrow & Ball) but I didn't want to buy lots of paint so I decided to settle for just parma gray. I didn't use a primer at all and the spent about 60 seconds sanding the table. It didn't seem to need it. I just slapped on two layers of paint on the base and three coats on the very top. It was very quick and easy and the result is a sight for sore eyes. For more money saving tips see Build Super Savings:  I wanted to buy cushions that matched my curtains but they cost £21 ($33) per cushion. I almost fainted when I saw that price! In the end I decided to just make my own cushion covers to match chairs I upholstered rather than the curtains. I had some left over material but it was only enough for one side of the cushion so I bought one plain patch off eBay at £1.24 ($1.92) including shipping (seriously, who can beat that?!!!). The zip cost me £0.55 ($0.85). I'm not even going to count the cost of the thread because it's negligible. Anyway this is how I went about it:

I got a pretty cushion that matches my chairs for less than £2 ($3) - now that's what I'm talking about. I had never sewn a cushion before, in fact I don't sew generally but it turned out alright. It's pretty amazing what you can do when you decide YOU WILL do it. If you like to save money like I do check out my ebook at katsonga.com and build super savings!

What a lucky find! I was walking down the street about a mile away from my house when I saw this solid wood bookcase dumped outside someone's home. I liked it immediately and I saw potential but I was on my own and it was large so I decided to leave it. A minute down the road I thought, no way man, that baby's coming home with me! I walked back up, knocked on the door and asked if they were throwing it away. The lady said yes so I took the shelves, as that's all I could carry and walked home to ask my hubby to come and help me collect it. Luckily, it fit in the car. I decided to paint the book case white and the legs Farrow and Ball's Parma Gray. It took two coats of primer and two coats of white wood paint to get the bookcase as white as I wanted it to be. When I was done painting I thought it looked a little boring. It needed some life so I thought I would wallpaper the sides fully but the Cath Kidston wallpaper I wanted was £25 ($40); I wasn't prepared to spend that kind of money on a full roll of wallpaper that was mostly going to be binned. I started trawling through eBay to find other people's left over wallpaper and stumbled upon an eBayer who had already cut flowers off Cath Kidston wall paper and sold the pieces to people like me that wanted to decorate furnitures. She cuts around the flower in a circle and leaves it to the buyer to cut neatly around each flower and leaf. So, that's what I did. Cutting around the flowers took a fair amount of time, maybe two hours because I wanted it done neatly. Then, using wall paper paste, I stuck the flowers onto the bookcase. If you want similar wall paper pieces just search "wall paper decoupage" on eBay. A pack currently costs £6.60 ($10) including postage. To be totally honest, I wasn't sure if I would like the outcome but once it was done I loved it. It's probably my favourite piece in the house because it took so much love, creativity and effort. I share a tonne of savings tips in Build Super Savings:  I'll admit it, old age poverty is one of my greatest fears. I will work against it at all cost. It turns out, I'm not the only one. According to a UK survey, almost a third of people, 31%, aged 45 to 54 cite a lack of cash in their 70s and 80s as their top worry. This is followed by a loss of independence (26%) and dementia (23%). I don't think about old age poverty very often but it's there at the back of my mind; I only think about it when I'm at the supermarket and I see someone who is well past it mopping the floors or swiping purchases. So what about being old and poor scares me?

We would combine our money and live in a big house together with a couple of qualified nurses helping us take care of ourselves. With this arrangement if someone's partner moved on to the next life we would still have each other for company. I've never thought about this co-op way of living before but thinking about it now feels good. I'll run it by my friends. What are you doing to stave poverty when you're old?  Most people enter into a mortgage and as soon as the docs are signed and sealed they forget about it. Some don’t even remember when it matures or what the rate is. At the point of renewal their broker or mortgage lender shows them a price and they think, that looks alright, and roll over for another two or three years. You could be throwing away a lot of cash if this is you! I used a mortgage broker the first time that I ever entered into a mortgage but I know the market so well now that I am my own broker. I prefer to shop for my own rates. Here are three simple things that could help you save a bucket load: 1. Set a reminder As soon as you secure a mortgage, if there is a chance of you forgetting when it matures set a reminder on your phone or computer. An alert two to three months before the mortgage matures is ideal. If it doesn't mature for 10 years or more, set a reminder to shop around for a new mortgage deal in 2 or 3 years' time. 2. Call your lender to quote you a new rate two or three months before maturity, then shop around for better! I was on a deal of 3.26% for two years at which point my mortgage reverted to the lender’s “standard variable rate” (SVR). Assuming an interest-only mortgage of £250,000, that’s about £15,990 over two years. When I called to ask for a new fixed rate, I was quoted a 2-year fixed rate of 3.39% plus a fee of £500. Assuming an interest-only mortgage of £250,000, that’s about £16,630 before the fee. I thought this sounded okay and frankly I felt too lazy to shop around. I called my husband to confirm that I was going to confirm the rate and as he trusts me he said fine and “have you looked anywhere else for a better deal?” I hadn’t and although I didn’t feel like it I decided to do a quick, half-hearted search just to say I had. Within 15 minutes I saw a 2-year fixed rate deal at 3.09% with a fee of £1,000. Some quick maths told me that this deal would amount to a saving of just under £1,000 over a two year period. 3. Call your mortgage lender and bargain The reason you call is because actually changing lenders is a bit of a hassle; a new lender will have to do a full due diligence on you whereas the existing lender already knows you, so if you can get the same deal where you are there will be far less work involved for you. I called up my lender and told them the deal I had found. I was happy to pay the £1,000 fee for the saving of 0.30%. Being a reliable payer, my lender matched the rate of 3.09% and kept their fee at £500. Result! Over the two year term that was a saving of about £1,500: enough to fund a brand spanking new iMac. I certainly wouldn’t sniff at that. Two months after I had secured this deal news broke that mortgage rates were going up across the UK economy…I was more than a little glad that I hadn’t waited until mortgage maturity to act! |

By Heather

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed