|

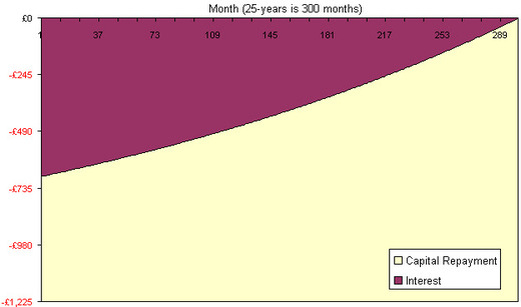

I'm really irked by the assumption that reduced payments are the only reason one would go for an interest-only mortgage. This seems to be the central assumption of every single article that I have found on the topic. With a standard fixed interest rate mortgage, fixed identical payments are made for the duration of the mortgage, call it 25-years and by the end of that term the mortgage has been entirely paid off such that the house is now fully owned by the person that took out the mortgage. With every payment that is made, part of the payment goes to interest and part of it goes towards chipping away at the borrowed money. To begin with most of the money paid goes towards the bank's interest and very little goes towards capital repayment and with every successive payment the interest portion falls whilst the repayment amount rises as in my diagram below (assumes a £250,000, 25-year mortgage with a fixed rate to term of 3.30%, payments are £1,225 per month). Simple. With an interest-only mortgage every payment goes towards interest only so at the end of the term you still owe the full amount on the mortgage. Simple? Actually, it's not really as straight-forward as that.

When I went mortgage shopping just over a year ago, the best interest rate I could find was on an interest-only mortgage. It just happened that this was the lowest interest rate I could find, however, note that it does not necessarily follow that interest-only mortgages have better rates than repayment-style mortgages. I wanted to pay as little interest as possible so I thought I would go for it provided my lender would allow capital repayments as well. It turned out that there were no restrictions on capital repayments and the mortgage was an "offset" mortgage as well. This means that if my mortgage balance is £100,000 but I have £10,000 sitting around in my current or savings account, I only pay interest on the £90,000 - win-win. I asked the lender what my payments would look like if this interest rate were applied to a standard repayment-style mortgage and decided to set up a standing order equivalent to the stated amount plus an extra £150. This meant that at the end of the first year I had paid almost £2,000 more than I would have had this been a standard mortgage. So, one can very well have an interest-only mortgage and treat it just like a normal mortgage, repaying some capital as and when it is affordable. A second advantage here is that if money is tight in any given month, I can reduce my mortgage payment to just the equivalent of the interest and not suffer any consequences such as a mark on my credit record or in the worst scenario, repossession. I believe I went the smart way about it (please tell me if I'm wrong), however, I do know several people who have gone interest-only and have never made a capital repayment since they got it. Not even once. All extra cash has been spent on fun and frivolities. This could either be because they are not aware of the fact that you can make overpayments on an interest-only mortgage or because they are not adequately thinking about the future. Owning my own home is my dream and the dream of many other people. Unfortunately, many still think of their home as entirely theirs even where the bank owns the largest holding. If you haven't thought about how you can use interest-only mortgages to your own advantage, I hope the above helps to nudge you forward in the right direction.

1 Comment

|

By Heather

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed