So, you're considering getting a mortgage and you want to see your banker with a firm understanding of what a mortgage is and how it works. Good. I'll sort you out with that knowledge. A mortgage is a type of loan. It's a loan for a piece of land or a property. The land or property acts as "security" or "collateral" for the loan. The asset backing up a mortgage is what makes a mortgage different to a regular, "unsecured" loan. A mortgage for a home is called a "residential mortgage"; a mortgage for offices, factories and other commercial properties is called a commercial mortgage. The "term" or "maturity" of the mortgage is the number of years over which you are borrowing the money. At the end of the mortgage term it will have been fully paid off. Your mortgage has a "principal value". The principal value is the amount of the mortgage. It's the amount that you borrow. Typically, the principal value will be lower than the value of the land or property. A bank is generally very unwilling to lend you an amount equal to the value of the property because if the property falls in value and you stop making your mortgage payments they will lose out. That is too risky for them. If you find a piece of land or property with a value of 100,000 and the bank decided it could lend you 75,000 to get that property then the "loan-to-value" would be 75%. This concept of loan-to-value (LTV) is an important one and a key mortgage term. The higher the loan relative to the value of the house, the higher the interest you will pay for that mortgage. Interest is the cost of a mortgage. However, note that the interest on a mortgage is "amortised" or paid down over the whole mortgage term. If you got a regular, unsecured loan of 100,000 and you were told the interest was 5% all you would need to calculate your interest payments for each year is the following formula: 100,000 * 5% = 5,000 This formula does not work for mortgage calculations. In order to find out your monthly payments you need more inputs. I will give you the inputs you need for the formula you can use in Microsoft excel to calculate monthly payments: Inputs required to calculate a mortgage: The value or principal of the mortgage, let's assume 100,000 for this example; The monthly interest, e.g. if you're told the annual interest rate is 12% then the monthly interest rate is 1% (12% divided by 12 months); The term in months - so if your mortgage term is 10 years that comes up to 120 months. For example purposes I will use the above numbers. · Monthly interest = 1% · Term = 120 months · Principal = 100,000 The function you will use in Microsoft excel is called PMT. The formula is: “=PMT(monthly interest, principal, term in months)” To calculate your monthly mortgage payment click any box in your excel spreadsheet, type exactly: =PMT(1%,120,100000,0) Don't type any spaces after the commas. You should get the answer 1,435. The "0" after the last comma basically says when 120 months have passed I want the value of the mortgage to be "zero" as is typically the case in a mortgage. Click to download my free mortgage calculator. If you don't have a computer at home then use the one at work. This is a very simple and basic formula but it will give you the confidence to go to your bank manager to talk about mortgages. Note that you can only use the PMT function if your interest is "fixed" - next week we'll talk about different types of interest: fixed, floating, discounted and so on. “More than anything else, what differentiates people who live up to their potential from those who don’t is a willingness to look at themselves and others objectively.” Ray Dalio (net worth $6.5bn)

0 Comments

Leave a Reply. |

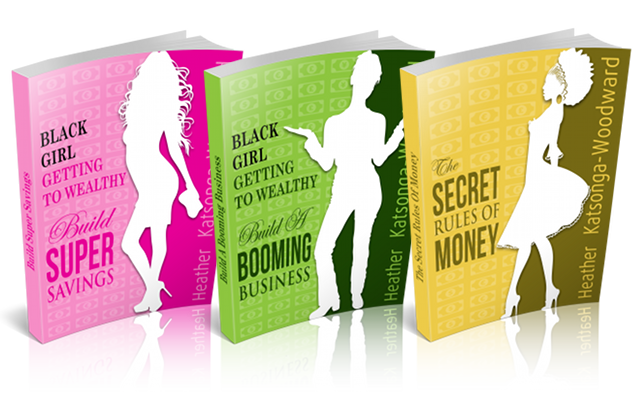

For 2 years until early 2014 I wrote a weekly personal finance and business column for Malawi's leading media house, The Times Group. The target is middle-class, working African women.

This is a reproduction of the articles that appeared in the weekend edition of Malawi News. Categories

All

Archives

May 2014

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed