Having collateral will help you to get a loan. However, sometimes you don’t have any physical collateral to show. Certainly when my father started out in business he had zero collateral. What he did have was a small business with a track record of earnings. Understanding the concept of “credit worthiness” can help you get a loan when you don’t have any collateral. First, what is credit worthiness? If a company or a person is creditworthy, they are likely to pay back their debts. Such a person or company is said to be a ‘good credit’. Good credits: Have better access to capital because the likelihood of lenders getting their money back is high so they are more willing to lend. Also, suppliers are more willing to give the company or person products on credit (i.e. with money to be received later) as they expect to eventually get paid for the goods. Companies and people with a good credit record have a lower cost of capital i.e. borrowing is cheaper for them; they have fewer conditions attached to the borrowing and they have a better overall reputation and access to opportunities. A ‘bad credit’ would, on the contrary, mean there is a high chance that funds will not get repaid. It follows that poorly rated entities find it hard and at times impossible to borrow. If lenders do decide to extend credit (i.e. to lend money to a bad credit), the rates tend to be prohibitively expensive with many strings attached. What is credit risk or credit exposure? Any entity (bank, investor, supplier etc.) that is owed money is said to have a credit exposure as they are ‘exposed’ to the risk of not being (re)paid. Within the realm of ‘good credit risk’ and ‘bad credit risk’ there are further layers of riskiness. Lenders assess all prospective borrowers using some standardized scale to enable comparison across companies and/or products. The rating given is called a credit score (for individuals) or a credit rating (for companies). Any lender, e.g. a bank or a bondholder, is exposed to the risk of not ever seeing their money returned. Companies that sell cars and other big items on credit (i.e. they allow the buyer to pay back over time) will never see some of that money again. Some mortgages will never be fully repaid. How Can You Prove You’re Credit Worthy Without Collateral? In the absence collateral you need to have a traceable track record. Starting a small business normally doesn’t require very much collateral. I know this because I have started a couple of small fruitful businesses in Malawi and abroad by simply being creative and resourceful. Sourcing inputs at a low price and selling at a price that generates adequate volume. Register your business and open a business bank account. Don’t mix your business finances with your personal finances. A business bank account is the very minimum you should have in terms of a corporate structure. Deposit all revenue into the bank account before you start spending on raw materials, salaries etc. These deposits are observable by your bank. When you request a loan you can refer to them as the source of income for repayments alongside a business plan that explains what the money will be used for. If your deposits are regular, over a three year time period that will give your business credibility and your bank should be willing to lend you some money. Outside of banks look at microfinance banks, e.g. Opportunity International Bank of Malawi. They lend without the need for collateral by lending to a group rather than to an individual. "Growth is never by mere chance; it is the result of forces working together." JC Penney

0 Comments

It’s useful to understand different types of equity because at some point you might want to grow your business by getting others to invest in it. Equity-holders partake in the ownership of a company. Equity includes any money that the founders of a company put into the business themselves and any money that they might have received from venture capitalists or other private equity investors. If someone gives you money in return for a share of your company they become an equity-holder or a shareholder. The money shareholders put into a company does not have to be repaid. In return for their investment, shareholders receive a share of any profits made. The payments made to shareholders are called dividends. If a company is liquidated shareholders are the last to be repaid. If after the debtholders have been paid there are no assets left to liquidate, then the shareholders get nothing back. Equity is therefore said to be subordinated, or rank junior relative to debt. Even within debt and within equity there are different subcategories which determine who needs to get paid first if a business goes bust. Types of Equity Start-up companies don’t have enough of a track record to get a significant bank loan or to raise equity in the capital markets (on a stock exchange). To fund growth they can obtain equity capital from one of the below. The list is not exhaustive. Angel investors are businesspeople that invest in high risk start-ups; they typically look to get their money back several times over, five times or more within four to eight years. The decision behind an ‘angel’ investment usually comes from an individual or family. Some angels group their funds together to enable bigger investments and economies of scale on admin, e.g. project due diligence. Venture capitalists (VCs) are a special category of private equity investors that invest in early-stage start-ups, typically in technology or some other unproven field. The investment will normally be smaller in size. As VC funds look at higher risk investments than mainstream private equity, they similarly look for higher returns: 10-50 times the initial investment within five years. Private equity investors (also known as ‘Financial Sponsors’) pool together the funds of various private investors and manage them in a fund. Investors can include high net-worth individuals, companies or even institutions like pension funds and insurance companies. The fund makes investment decisions in a formalized manner as dictated in the private placement memorandum (PPM) that is used to set the fund up and attract money from investors. Private equity investors typically look for a return of 20-30%. To buy an asset, mainstream private equity funds will combine private equity with bank debt How do these equity investors get their money back? Firstly, by selling the asset. Secondly, by listing the asset on a public stock exchange through an Initial Public Offering, IPO. Thirdly, dividends may also be paid by the assets of private equity firms but are not likely in angel or venture capital investments as all funds are typically ploughed back into the business to generate growth. Crowd funding is money sourced from ordinary people normally through some internet-based method. Frequently, funds sourced from the crowd don’t have to be paid back. A business that raises capital from the crowd receives small amounts of money from many people, most of whom are not professional investors. The contributors will all be people that appreciate the business idea under consideration and possibly see themselves or their friends and family using it. With the growth of the internet and the ease of making e-payments, crowd funding has grown rapidly in recent years. Check out milliondollarhomepage.com for the kid who raised over USD1 million in just 128 days to fund his university education through crowd sourcing and he doesn’t have to pay it back! “In investing, what is comfortable is rarely profitable.” Robert Arnott  “My first language was shy. It's only by having been thrust into the limelight that I have learned to cope with my shyness.” Al Pacino Career success favours the most confident man or woman. If you find it difficult to approach people that you don’t know, at work or indeed in the process of finding a job, here are some useful tips to help you strike up a conversation: 1. Practice, practice, practice Practice networking with people that you are already comfortable with such as family, friends, teachers or even colleagues. Practice will make you feel better prepared for any networking events including interviews and also networking on the job. Ask the person you are practicing with to give you honest pointers on how you can make yourself look like the better candidate. 2. Get introduced If someone you know already knows the connection you want to make, they will probably be happy to introduce you. This way you don’t have to think of an ice breaker. More often than not this sort of introduction builds itself up into a conversation. 3. Fake confidence until you actually feel it Hold your head up high and smile. No one else knows that you are nervous; you can successfully portray confidence without in fact feeling it. A little test for you: next time you walk into a full room, try to identify the confident from the shy and reserved. It’s dead easy to spot, right? Their behavior gives each group away. The more you put yourself out of your comfort zone, e.g. by approaching strangers at networking events for a chat when you normally would not feel comfortable doing so, or by approaching a manager you’re a little scared of at work, the easier it becomes. 4. Be yourself and stick to subjects you are knowledgeable about Don’t present yourself as something you are not; a little lie can spiral out of control especially if you tell different people different lies. Being yourself obviously extends beyond telling the truth: it’s about behaving naturally. For instance, just because an interviewer is from a very different background, it doesn’t mean you have a lower chance of getting the job. To the contrary, you might be perceived as someone that will add a different perspective to corporate strategy because you are different. 5. Tackle your fear of rejection The people you want to talk to are probably just as nervous as you are, maybe more so. What’s the worst that could happen: the person hurries off looking uninterested? If so, do you care that much? At least you tried. Think of it as their loss. 6. Get the other person talking to take the pressure off of you You should find yourself getting less anxious as the other person talks. Hopefully, you’ll come up with questions based on what they say. 7. Google or get a book for more tips on tackling shyness If you think you need more than the above there is plenty of material out there. I will end this article by wishing a very special HAPPY BIRTHDAY to the woman that taught me confidence, my dearest mother, Agnes Katsonga-Phiri; you are the best role model in the world. “I wondered how many people there were in the world who suffered, and continued to suffer, because they could not break out from their own web of shyness and reserve, and in their blindness and folly built up a great distorted wall in front of them that hid the truth.” Daphne du Maurier  This article is a continuation from last week. “To be successful, you have to be able to relate to people; they have to be satisfied with your personality to be able to do business with you and to build a relationship with mutual trust.” George Ross These are my next five tips:

Discuss different ways of handling technical questions, where people are applying, what career-related events people are attending, whether they can share contacts with you, what they know about the different companies, what questions they have been asked at interviews and so on. To get ahead it is best to treat your peers as collaborators not as competitors. The more open you are, the more others will share information with you. 2. Always send a follow up email to new contacts: a ‘thank you’ or ‘great to meet you’ email always goes down well. In addition, you can elaborate on a discussion you had or perhaps remind them to send you something that they said they would or vice versa. 3. Join LinkedIn. You can use this as a tool to connect with any new contacts you have made. Try to get your lecturers, colleagues and any previous managers that you’ve had to give you a recommendation on LinkedIn. Potential employers may see it. 4. Find a mentor or a coach. A coach will give you constructive feedback on the quality of your answers to interview questions, your body language, the tone of your voice and importantly how you can improve. 5. Finally, don’t ask silly questions! After joining a niche investment banking-related society, I had exposure to many high-ranking bank officials at networking events and I made it a point to ask something smart, so much so that my peers began to recognize me as the girl who likes asking questions. At the end of the experience the organisation awarded me recognition as ‘The Most Insistent Person.’ Don’t ask me what that means! How To Fend Off Lustful Men Let’s face it. The majority of people that you need to network with and impress are going to be men. We still live in a society where most key positions are held by men. It’s important when you are networking that you don’t create the wrong impression because when you get the job you may find that there are some tasks on your job description that you didn’t realize would be there. Or even worse, the worst offenders will try to get sexual favours under the guise that they will get you a job. You should not need to stoop to this level. First, dress appropriately. If you’re dressed in a business suit that isn’t too tight-fitting or revealing unnecessary skin the way you look won’t encourage bad behaviour. Next, don’t flirt in any way shape or form. Flirting in a Western context usually ends there but my friend, in Malawi, people always want to take it to another level. Finally, talk business only, keep off personal topics as much as possible. If you are looking for a professional job you should be able to discuss related topics. I hope you’ve found these tips useful and that you will begin to take action to get the best job possible for you! “Networking is marketing. Marketing yourself, marketing your uniqueness, marketing what you stand for.” Christine Comaford-Lynch  I was in two minds about writing this article. I thought that networking is not a relevant topic because everyone in Malawi already knows everyone. However, after a couple of weeks I realized that I am only thinking in this way because I have had the luxury of hiding behind my parents who can give me access to almost everyone in Malawi – I’m very lucky in that sense but this scenario is not true for most people. Importantly, I got my first proper job in the UK securing a role at an investment bank that every single one of my friends at Cambridge University wanted to work in, Goldman Sachs. I didn’t have a single connection in that world but it didn’t worry me, I knew I was resourceful and would get where I needed to go somehow. Ultimately, I had to network aggressively in order to get the job and in this article I tell you five of the top things I did as far as networking is concerned. I know there are girls out there who have come out of university and think they can get a job better suited to their education and how hard they work but they’re not quite sure how. This article is for you. Above all else, building a cache of contacts helps your career in direct and indirect ways. These are my first five pointers on networking:

“You can make more friends in two months by becoming interested in other people than you can in two years by trying to get other people interested in you.” Dale Carnegie |

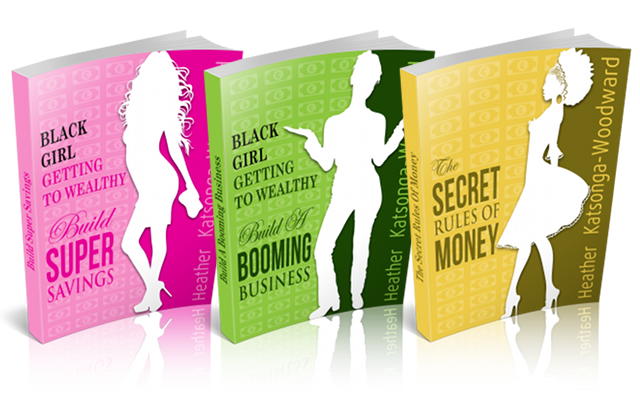

For 2 years until early 2014 I wrote a weekly personal finance and business column for Malawi's leading media house, The Times Group. The target is middle-class, working African women.

This is a reproduction of the articles that appeared in the weekend edition of Malawi News. Categories

All

Archives

May 2014

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed