Last week we defined “the rat race” and for the last week you have been meditating upon what it would feel like to be “financially free. Today, I present some rules for getting out of the rat race and enjoying financial freedom. Platinum rule: annualise expenditures. I will explain what this means with an example: imagine you want to hire a cleaner at the cost of c. MWK20,000 a month. It does not sound like very much in isolation but there are 12 months in a year which means that the cleaner would cost MWK240,000 per annum. If you are getting a cleaner to release time to run a business, this is fine but you probably just want extra leisure time to watch more TV or for social gatherings – not fine. You can annualise anything – beer money, eating out money, “entertainment” money and so on. Annualising can help you to rein in expenditure. Golden rule: borrow only to invest, at all costs avoid borrowing for consumption. Don’t wait for a slump in the property market before you buy a home. Why would you do that? If you buy a house today for a MWK10,000,000 and next year the value falls to MWK8,000,000 (possible but improbable), if you bought the house as a home and not just as an investment, in the long run it really doesn’t matter. At some point, prices will pick up and/or you will finish paying of any debt incurred to buy the house. Once the debt is paid off, you have a home and income from work and investments only needs to pay the bills. This golden rule can be a little tricky. If you have MWK1,000,000 and want to buy a car worth MWK800,000, should you buy cash? Well, if you have an investment opportunity that will give you a good yield, borrow to buy the car and invest the cash you have. If your car loan costs less than the investment yield, it’s a wise decision. Moreover, even if you lose money on an investment, you won’t have lost the lesson. Most other types of debt are bad: pay off all consumer loans as fast as possible. Silver rule: do not make other people’s problems your own. If someone asks to borrow money, understand why they need the money, what they will use it for and how and when they intend to pay it back. Frequently, we feel pressured to lend to friends and family when, deep down we don’t trust that credit exposure – just say no. It can be hard and you may lose a “friend” but you probably won’t regret your decision. If you can, just share them what money you can afford to give. There’s nothing wrong with helping a friend in need. Bronze rule: learn and educate. Educate yourself because it opens up opportunities. Educate your children so they too can gain independence at some point. That’s all from me. If you follow just the golden rule combined with a sprinkling of foresight and burning desire to be financially free you will be fine! “A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life.” Suze Orman For inspirational quotes follow @Getting2Wealthy on twitter.

0 Comments

Leave a Reply. |

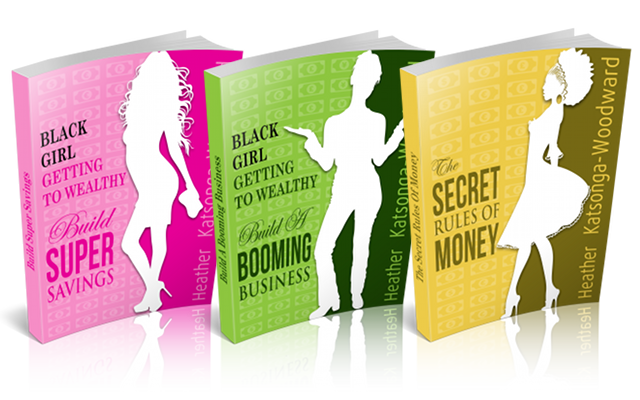

For 2 years until early 2014 I wrote a weekly personal finance and business column for Malawi's leading media house, The Times Group. The target is middle-class, working African women.

This is a reproduction of the articles that appeared in the weekend edition of Malawi News. Categories

All

Archives

May 2014

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed