Everyone likes to win, everyone likes to be the best and to look their best, this is why many endeavour to "keep up with the Joneses". How often have you looked at an object that your friend has - a handbag, a dress or even a house and wished you had the same? For some, it happens almost every day. It's a real problem. This quest to keep up with and look better than our neighbours can be positive or negative. If it drives you to work harder and to focus on bettering yourself, it's a positive If it causes you to find a sugar-daddy or to go for other people's husbands then it is a negative. For the most part we don't know what our neighbours have had to go through to purchase the things that they have. We don't know how many sleepless nights they have had to suffer nor do we know how much debt they are in. The Cost of Keeping Up With The Joneses I believe it's better to spend the first years of your working life accumulating wealth rather than accumulating possessions that fall in value from day one. Invest in decent clothes for work but beyond that you might achieve more over the course of your life if you put all your money and effort towards developing an appreciating asset base. Small amounts of money quickly add up. This week you buy a lipstick on a whim, the next week a pair of shoes, the week after a dress. However, if you chose to save this money instead you could soon have enough to grow maize, rear animals for sale or invest in a machine to start a business. How Do You Fight The Urge To Keep Up With The Joneses? It can be a very hard urge to fight especially in a country where people know and refer to others by their car’s number plate. However, here's what you could do: 1) Think about what you are working towards instead. It might take you 18 months to save $1,500. You can either choose to save that $1,500 to invest in a machine that produces a monthly profit of, say, $300 per month; or you can spend it. If you spend it, you have nothing to look forward to. If you save the money you'll have the pleasure of being a business owner and you'll make the money back within 5 months once you get the machine. Not only that, if the machine lasts two years you'll make $7,200 that you would not have made otherwise. This is the trade-off between enjoying life now versus saving and enjoying life a lot more later. What do you prefer? 2) Find a way to derive enjoyment from something other than looking good and having all the nicest things. This is one of the best things to do because once you get to a stage where you derive fulfilment from a hobby that doesn't cost you anything, you're onto a money-saving, asset-building, envy-free future. 3) Stop caring about what other people think. I've once heard it said that if everyone threw their problems onto a pile you would quickly pick your own problems back up again. Next time you’re admiring something that someone else has remember this fact; if you saw their problems you’d be much less envious of their situation. "Keeping up with the Joneses was a full-time job with my mother and father. It was not until many years later when I lived alone that I realised how much cheaper it was to drag the Joneses down to my level." Quentin Crisp For inspirational quotes follow @Getting2Wealthy on twitter.

0 Comments

Leave a Reply. |

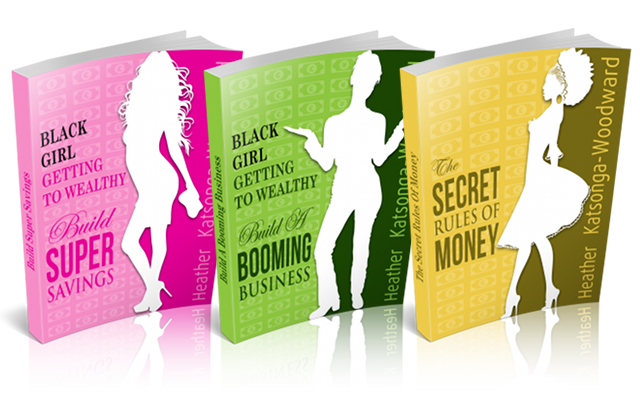

For 2 years until early 2014 I wrote a weekly personal finance and business column for Malawi's leading media house, The Times Group. The target is middle-class, working African women.

This is a reproduction of the articles that appeared in the weekend edition of Malawi News. Categories

All

Archives

May 2014

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed