Understanding different types of loans can help you to negotiate with your banker like a pro! If you can get your head around different financial concepts you can not only push your personal financial situation forward but your business life too. Let's chat about different types of loans or mortgages. All the below concepts are equally applicable to regular loans and mortgage-style loans. Fixed vs. floating (or variable) interest When you borrow money from a bank the interest rate is either fixed or it's variable, also known as floating. Fixed Interest Rates If the interest rate is fixed then it does not change for a certain duration of time; it can either be fixed for the full term of the loan or mortgage or for just part of the term. For example, you might have a 10-year loan with a fixed rate of interest for all ten years or a fixed rate of interest for the first two years only followed by a variable interest rate after those two years. Floating or Variable Interest Rates When the interest rate on a loan is variable it is reset periodically. It might be reset every month, quarterly, every six months or even annually. A variable loan is more risky for the borrower but it is less risky for the bank. It's more risky for the borrower because when you take out the loan you only know what the interest rate is in the initial period but you have no idea whether it will go up or down whenever it is reset. Why would anyone choose a variable interest rate then? Because variable rate loans are less risky for banks they are usually cheaper than the equivalent fixed rate that you can get at the same time. If your interest rate is fixed but interest rates in the economy start falling then you lose out. However, the opposite is also true, if interest rates are rising but you have a fixed rate then you're safe. Interest-only Loans You can get a loan or mortgage whereby you pay just the interest on a monthly basis and you only repay the entire borrowed amount at the end of the loan term. This may make sense if your money is locked up in an investment and you expect to receive a lump sum of money in the future. An alternative would be a loan with an initial discounted rate or a period of non-payment. How would that work? Discounted Rate Periods A loan can be structured such that you pay a low rate for an initial pre-agreed period followed by a higher rate after the discounted period is over. If you have a solid business or investment case you might even be able to secure a loan where you repay nothing at all initially (maybe a year or two) followed by a period during which the loan is repaid including interest. This is how it might work: Let's say you or you and your family own some properties but you don't want to sell them to finance a project - let's say it's a project to build flats that will take two years. You can go to your bank and use your existing assets as collateral but explain that until your project to build new flats has been finished your cash flow is restricted. The bank, considering you to be a good risk especially with your collateral, might then consider a discounted interest rate for two years or a period where you pay interest only or even a period where no payments at all are made. You can also do this on a much smaller scale. Let's say you want to go to Dubai to buy a minibus or two for business. You can explain this to your bank to get just 3 to 6 months of discounted interest payments. The more fluent you are in finance the better able you will be to negotiate. Next week I'll tell you how my mum used her understanding of finance and credit as a young 20-something year old to start a business. "An investment in knowledge pays the best interest." Benjamin Franklin

2 Comments

24/4/2023 06:11:35 am

Thank you for providing this information on different loan types. It's a great resource for frequently asked loan questions.

Reply

17/5/2023 02:44:38 am

Hey, thanks for sharing your expertise on types of loans . Your website is a treasure trove of knowledge, and I'm excited to delve deeper into your blogs. Your insights are invaluable, and I can't wait to learn more from you.

Reply

Leave a Reply. |

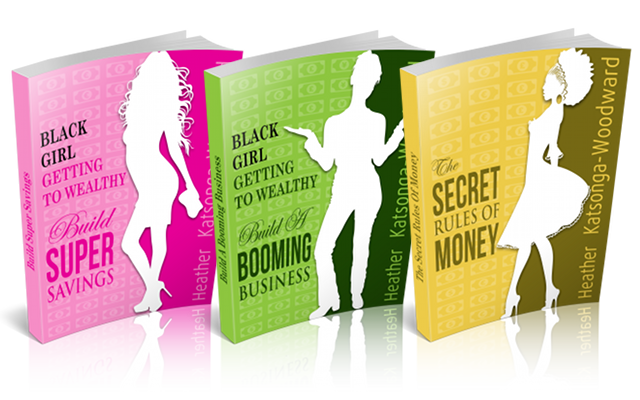

For 2 years until early 2014 I wrote a weekly personal finance and business column for Malawi's leading media house, The Times Group. The target is middle-class, working African women.

This is a reproduction of the articles that appeared in the weekend edition of Malawi News. Categories

All

Archives

May 2014

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed