Having collateral will help you to get a loan. However, sometimes you don’t have any physical collateral to show. Certainly when my father started out in business he had zero collateral. What he did have was a small business with a track record of earnings. Understanding the concept of “credit worthiness” can help you get a loan when you don’t have any collateral. First, what is credit worthiness? If a company or a person is creditworthy, they are likely to pay back their debts. Such a person or company is said to be a ‘good credit’. Good credits: Have better access to capital because the likelihood of lenders getting their money back is high so they are more willing to lend. Also, suppliers are more willing to give the company or person products on credit (i.e. with money to be received later) as they expect to eventually get paid for the goods. Companies and people with a good credit record have a lower cost of capital i.e. borrowing is cheaper for them; they have fewer conditions attached to the borrowing and they have a better overall reputation and access to opportunities. A ‘bad credit’ would, on the contrary, mean there is a high chance that funds will not get repaid. It follows that poorly rated entities find it hard and at times impossible to borrow. If lenders do decide to extend credit (i.e. to lend money to a bad credit), the rates tend to be prohibitively expensive with many strings attached. What is credit risk or credit exposure? Any entity (bank, investor, supplier etc.) that is owed money is said to have a credit exposure as they are ‘exposed’ to the risk of not being (re)paid. Within the realm of ‘good credit risk’ and ‘bad credit risk’ there are further layers of riskiness. Lenders assess all prospective borrowers using some standardized scale to enable comparison across companies and/or products. The rating given is called a credit score (for individuals) or a credit rating (for companies). Any lender, e.g. a bank or a bondholder, is exposed to the risk of not ever seeing their money returned. Companies that sell cars and other big items on credit (i.e. they allow the buyer to pay back over time) will never see some of that money again. Some mortgages will never be fully repaid. How Can You Prove You’re Credit Worthy Without Collateral? In the absence collateral you need to have a traceable track record. Starting a small business normally doesn’t require very much collateral. I know this because I have started a couple of small fruitful businesses in Malawi and abroad by simply being creative and resourceful. Sourcing inputs at a low price and selling at a price that generates adequate volume. Register your business and open a business bank account. Don’t mix your business finances with your personal finances. A business bank account is the very minimum you should have in terms of a corporate structure. Deposit all revenue into the bank account before you start spending on raw materials, salaries etc. These deposits are observable by your bank. When you request a loan you can refer to them as the source of income for repayments alongside a business plan that explains what the money will be used for. If your deposits are regular, over a three year time period that will give your business credibility and your bank should be willing to lend you some money. Outside of banks look at microfinance banks, e.g. Opportunity International Bank of Malawi. They lend without the need for collateral by lending to a group rather than to an individual. "Growth is never by mere chance; it is the result of forces working together." JC Penney

0 Comments

Leave a Reply. |

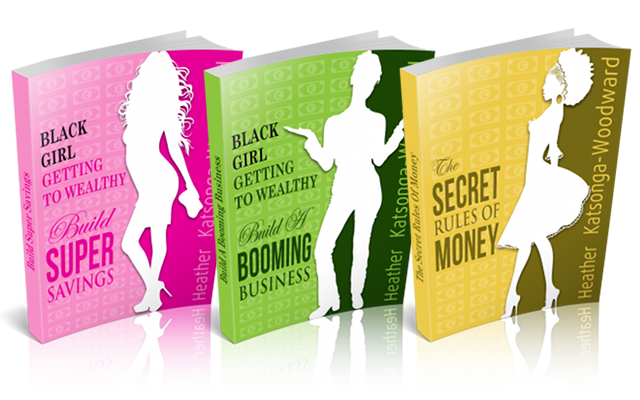

For 2 years until early 2014 I wrote a weekly personal finance and business column for Malawi's leading media house, The Times Group. The target is middle-class, working African women.

This is a reproduction of the articles that appeared in the weekend edition of Malawi News. Categories

All

Archives

May 2014

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed