|

You would be forgiven for believing that buying shares is a get-rich-quick scheme. In recent years in Malawi shares have been heavily underpriced when they’re brought to market in an initial public offering (IPO); this means that there have been more people wanting to buy shares than there are shares available.

What happens when demand is so high relative to supply? If a company wants to have 100,000 shares listed on the Malawi Stock Exchange they would offer them at a fixed price. If they receive demand for more shares than this the price will stay the same and the number of shares also stays the same so some people don't get any or get less than what they want. Note that if there is a "greenshoe option" in the share offering documentation then they can issue up to 20% more shares but they cannot change the price once orders are being received. Once the offering is closed the shares become available to buy and sell on the open market. Those people that didn't get as many shares as they wanted are free to buy from those that did. What's the result of this? An increase in share price. Basic economics dictates that when demand rises, prices rise. So after a share offering that has been underpriced it is not uncommon to see the price shoot up. I heard of one woman in Malawi borrowing money to buy shares in an IPO and then selling them within a week with enough profit to buy a car AND repay the lender! By the same token, however, once the initial buying and selling frenzy is over the share price settles down to an equilibrium price. Once the share price reaches this level it can stay there for a prolonged period of time because, for the most part, the share dealing market in Malawi turns over very low volumes. If you bought when the market was high you may have to hold onto a loss position for a long time. Secondly, shares may come down in price because a large shareholder decides to sell. For instance when the Malawian economy is doing badly large international shareholders cut their losses by selling their entire portfolio. What should you do if you're in a loss-making same position? 1. If you don't need the money desperately, hold onto the position until the shares move up in price. The Malawi Stock Exchange can email daily or weekly updates to you so you can keep up to date with pricing. 2. If you think the company is definitely on its way to financial ruin, cut your losses and sell. It's better to recover some of your money than to lose all of it. When you’ve been holding a losing stock for a while the temptation to sell very high but try to be as rational as possible. I bought Apple Inc. shares at $78 in 2006; in late 2008 / early 2009 the share took a beating and was treading well below previous highs of $200. I decided that the I’d sell as soon as the stock price hit 280 and that’s what I did feeling very proud that I had more than trebled my money since 2006 – I have lived to regret the decision ever since: the share price continued its upward streak for years and traded as high as 700 in late 2012! "When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever." Warren Buffet

0 Comments

Leave a Reply. |

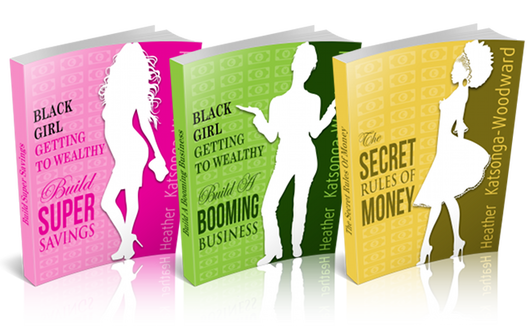

For 2 years until early 2014 I wrote a weekly personal finance and business column for Malawi's leading media house, The Times Group. The target is middle-class, working African women.

This is a reproduction of the articles that appeared in the weekend edition of Malawi News. Categories

All

Archives

May 2014

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed