Some people think New Year’s Resolutions are pointless. What's the point in waiting until the 31st of December to make a change that you can make sooner; I don't entirely agree. You should be dynamically adjusting your life and your finances to take account of new circumstances. That said, you need to stop at some point and take stock of the last six or twelve months to see if your plans are working. You can't do that every day; you're probably too busy. So what goes into your New Year's Resolutions? Everything: your finances, your career, your love life and everything in between. I would encourage everyone to affirm their resolutions by writing them down. Did I do or achieve everything I set out to do in 2012, no, but writing it down helped me get closer. Don’t make your plans too complicated. Have one or two big goals for 2013 and several small goals. Get a pen and paper out and write a draft of your New Year’s Resolutions based on these questions: Start off with your home: are there things you could have done to be a better girlfriend, wife or mother? Financially, would you like to exercise better control over your spending habits in 2013? How do you plan on doing that? Do you want to get a promotion at work? How are you going to let your boss know that you are worthy of the promotion? Don’t get ahead by pushing others down; that sort of success is empty. Do you want a pay rise? How do you plan on telling your boss? How will you justify your request? High inflation is probably not a good enough justification. Do you have a business? What are your business goals for 2013? Will you sell the same products or expand your offering? What are your sales goals? What is your plan for attracting new customers? Do you want to start a business in 2013? Have you written a list of the things you will need to get the business going? Are your funds sorted? Would you like to learn a new sport or improve your health? How do you plan on doing that? If you want to lose weight, exactly how much do you want to lose? How do you plan on changing bad eating habits? It’s easier to achieve financial success if you yourself are healthy. Don’t aim to achieve too many things for you will end up achieving nothing. When things aren’t going the way you want, be patient. The financial success one can achieve as an employee is limited and that may be good enough for you. If you want to boost your income start a business: the upside is unlimited, the downside limited. You don’t need to resign to start. Labour is quite cheap in Malawi so set your plan and get someone to work for you. You could get a relative to work for you for free but keep in mind that relatives can pilfer your money just as easily as a neutral party if not more so. When things take off you can start running your business on a full-time basis. “The majority of men meet with failure because of their lack of persistence in creating new plans to take the place of those which fail.” Napoleon Hill

1 Comment

9/6/2021 09:39:22 am

One of the best decisions a person can make if he wants to start his business, but there are some situations where the person cannot handle his business or wants to close it. But dissolution is not easy, here are some steps to dissolving an LLC.

Reply

Leave a Reply. |

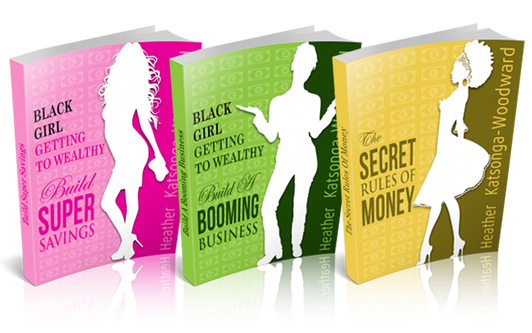

For 2 years until early 2014 I wrote a weekly personal finance and business column for Malawi's leading media house, The Times Group. The target is middle-class, working African women.

This is a reproduction of the articles that appeared in the weekend edition of Malawi News. Categories

All

Archives

May 2014

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed