How to split bills is the subject of many interesting discussions. Eating out at a nice restaurant is not cheap. If you like to eat out regularly then it shouldn’t necessarily fall to your boyfriend or husband to pick up the tab, there is nothing wrong with you paying too. In the pre-marriage stage my personal preference is for boyfriends and girlfriends to take each other out. You pay one time and he pays the next. If you eat in a very expensive place one of the times then the other person can pay twice in row etc. I decided early on that a 50-50 split does not work in a relationship. It is so impersonal; it doesn’t show a unified front and it is the reason that I eventually broke up with the man I dated prior to my now husband. This is the story: It was my birthday and we went out to eat at a cheap Chinese place – I was okay with the cheap and tacky environs as I knew he was saving to buy a house. When the bill came I threw my debit card onto the table fully expecting my then boyfriend to say, “It’s okay, I’ll pay”. He did not. The bill wasn’t even high; it was very affordable but the idea of me paying to eat out on my own birthday made me feel very unloved. Even when I asked if he would allow me to pay he just shrugged and said, “Well you took your card out”. I was not happy. I knew from that moment that it was over; something significant would have had to happen to convince me otherwise. I had seen enough to know that this was a stingy man. He treated me well generally but he had a funny take on money and finances and I wasn’t going to marry him for that. I knew my worth. The only reason I didn’t split up with him immediately is that he’d bought Chris Rock tickets for a show three months later and I decided I could hold out until then to see if there was anything worth salvaging. I can be cold and objective like that! Beyond boyfriends If you are married or are in an advanced stage of your relationship then the ‘taking each other out’ model needs to change. Talk about how you will split bills before you get married. Eating out is one thing but marriage becomes real when you have bills and rent to pay. My personal solution is to get a joint bank account for common expenses. This works where you and your husband are financial equals. My husband and I lived together for almost two years before we got married and about a year before he proposed, this was a fantastic decision because we really came to understand each other financially. I made an assessment of how much all of our monthly bills would come to every month including an allowance for eating out plus a buffer and then I determined how much we should each put into our joint account. You could try the same model. If you’re both paying the same amount into the account then you never have to talk about who will pay the electricity or the water. Importantly, no one will have to be upset that they are paying more bills than the other because you’ve both contributed 50-50 to the account. Due to inflation you will need to regularly reassess how much you should each pay into the joint account. If one partner earns very little then perhaps they can contribute less to the joint account. Decide between the two of you. “We all need money, but there are degrees of desperation.” Anthony Burgess

0 Comments

Leave a Reply. |

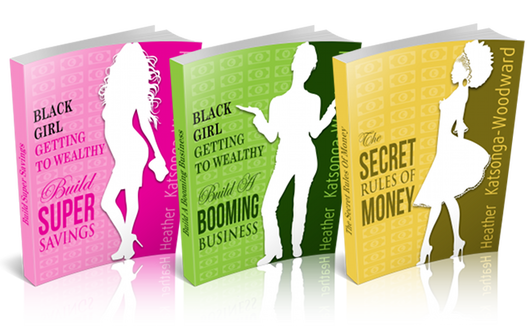

For 2 years until early 2014 I wrote a weekly personal finance and business column for Malawi's leading media house, The Times Group. The target is middle-class, working African women.

This is a reproduction of the articles that appeared in the weekend edition of Malawi News. Categories

All

Archives

May 2014

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed