Cash is the worst thing to keep when inflation is not only high but also highly unpredictable. You need to put your money into assets that don't lose value. I knew the Malawian economy was overheating all the way back in July 2011 when I was preparing for my wedding. For this reason I paid for all the catering in advance because it would commit the hotel to provide it and they couldn't increase the cost to me regardless of any change in economic circumstances. The moment I got married in 2011 I told my mother to spend all the wedding proceeds on cement. "Don't keep any cash," I said, "It will be valueless in a few months". It was a very wise move. Within 6 months we faced a sharp devaluation and I fortunately didn't have much cash sitting around. It had all been invested in property related expenditures. Overall, there are 3 main ways to ensure you don't lose out (too much) from hyperinflation: 1. Invest in property You don't need to buy a whole house. You can invest in property by building your own house in small phases. Even if you eventually decided you can't afford to finish the house, the land would be of much higher value with some form of structure on it rather than if it's sold as an empty piece of land. 2. Invest in business stock If you have a business it's better to keep stock rather than cash. This is because if the value of the kwacha falls you can just charge more for your stock but if you have cash sitting in the bank it will be of less value and there's nothing you can do about it. If you run a service business that doesn't require much stock then consider bringing forward any capital expenditure or starting to sell actual products so you can move your money into stock. 3. Buy quality art This is a very Western suggestion but I'll suggest it nevertheless. Many people value high quality art work. If you have an eye for good art, and I'm not talking about run-of-the-mill ziboliboli, but really unique pieces, then you can buy art and either keep them as a store of value or sell them as a business. Go to La Caverna (Mandala House) in Blantyre and have a look at their collection. The business serves as an art gallery in addition to being an art shop. Whoever the buyer is has a real eye for good art. 4. Buy USD, EUR or GBP The USD, the EUR and the GBP (in that order) are very stable and also very widely accepted. Many of us have friends that live abroad but need kwacha for one thing or another. Buy their currency and give them kwacha. You can exchange the money back to kwacha as and when you need to or use it. This fourth suggestion is viable for anyone because you can buy amounts as small as USD10 at a time. For those that have lived abroad and have accounts in the US, UK, Europe and Australia you can have the funds paid directly to your account so that you don't have to worry about losing the money or it being stolen. The money situation is very precarious right now. You need to think smart if you want to get ahead. “Inflation is the one form of taxation that can be imposed without legislation.” Milton Friedman

1 Comment

Pacharo Lisa Malopa

13/1/2014 10:20:38 pm

I find this very valuable, many people living outside the boarders of Malawi do not think of investing back at home and when time comes that they need to relocate back home they are faced with challenges of where do I start leading to costly investment mistakes.

Reply

Leave a Reply. |

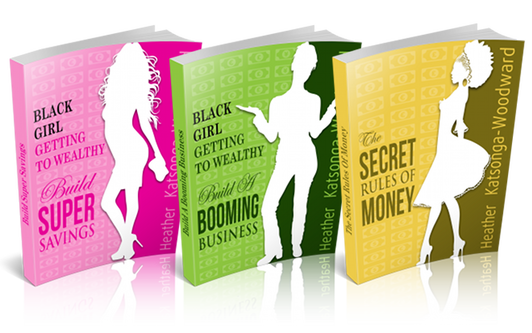

For 2 years until early 2014 I wrote a weekly personal finance and business column for Malawi's leading media house, The Times Group. The target is middle-class, working African women.

This is a reproduction of the articles that appeared in the weekend edition of Malawi News. Categories

All

Archives

May 2014

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed