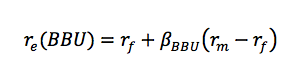

Have a technical interview lined up in corporate finance (a.k.a. IBD)? Then make sure you can answer each of the below questions competently. Your job depends on it! 1. What is the difference between a buy-side advisor and a sell-side advisor? Which would you prefer? 2. Do you know any valuation metrics? Describe them. 3. What do you think about the current state of the US economy? 4. Explain one important way in which a balance sheet is different from both an income statement and a cash flow statement. 5. What is leverage? 6. Do you know any leverage ratios? Which ones? 7. What is WACC? 8. What is the capital asset pricing model? 9. Describe five synergies that would result from a merger between Vodafone and Sky TV. 10. Tell me about 3 businesses that are probably flourishing in the current economic environment and explain why you think they would be flourishing. 11. Tell me about a stock you like and why. 12. What type of information goes into a pitch book? Book a mock interview to ace that interview! Best of luck!!  by Girl Banker Listen to the iTunes podcast instead. Competency-based questions are designed to elicit your key qualities, e.g. your experience with working with others (team work), being a leader, taking initiative, overcoming obstacles, making quick decisions and so on. Here are some common questions: 1. What do investment banks do? How are investment banks different to commercial or retail banks? 2. Why do you want to work in corporate finance / sales / trading / asset management? Why do you think you would be good at corporate finance / sales / trading / asset management? 3. Why do you want to work for this bank? 4. Why should this bank hire you? What do you think distinguishes you from other candidates that have applied for this position? 5. Do you know this bank’s key competitors? What do you know about other investment banks? 6. Run me through the key aspects of your résumé/CV? 7. Describe yourself This is a very open-ended question so you should ask if there is anything the interviewer particularly wants you to talk about, e.g. your work experience or your ambitions, your degree and why you chose it, your university and why you landed there, your extracurricular activities etc. 8. You’re currently doing a non-financial course in university. Given this fact, what attracted you to investment banking? With so little financial knowledge, how would you be useful to us? 9. Would you describe yourself as hard-working? 10. What are your key strengths? 11. How would someone that knows you well describe you? 12. What do you like the most about yourself? 13. What is your biggest achievement? 14. Do you have any weaknesses? What would you classify as your key weaknesses? 15. Have you ever failed? Have your plans ever not worked out? Tell me about a time when something went wrong. How did you resolve it? 16. What is the biggest failure you have ever had? 17. The grades on your résumé/CV are not the best I have seen today. Why should I hire you over someone with a better academic profile? 18. Which other firms have you applied to? Which other firms are you interviewing with? Have you received any internship / job offers yet? 19. Are you only applying for positions in investment banks or are there other sectors you are considering? 20. How did you prepare for this interview? 21. Are there any questions you would like to ask me? If you can fully prepare just the above questions for your competency based interview, you will be more than prepared. To Become an Investment Banker provides guidance on how to answer each one of these questions effectively. Book a mock interview to ace that interview!  by Girl Banker Listen to the iTunes podcast instead. You cannot go to a corporate finance or asset management interview without knowing the CAPM. The CAPM model shows that the return to equity is a positive function of risk: BBU (Blissful Books United) is the fictional book store created in my book To Become an Investment Banker.

o US Government bond yields are relatively easy to get a hold of online. Some portals will even allow you to download historical data into Excel. o The downgrading of the US Government rating from AAA to AA+ by Standard & Poor's rating agency makes the usual text book assumption that the US Government is risk free debatable.

o If BBU is less volatile than the market, on average, β(BBU) will be less than 1. o If BBU is more volatile than the market, on average, β(BBU) will be more than 1.

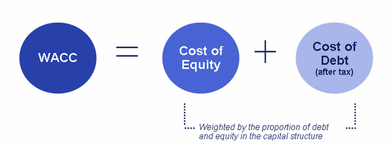

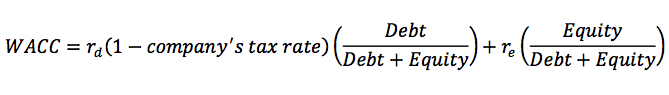

You might also like: What is WACC, the Weight Average Cost of Capital? Where can you get the cost debt used to calculate WACC?  by Girl Banker Listen to the iTunes podcast instead. WACC represents the combined cost of debt and equity The free cash flows in Discounted Cash Flow (DCF) Analysis are normally discounted using the weighted average cost of capital, WACC. Where:

r(d)(1 - company's tax rate) is the post tax cost of debt. E.g. If:

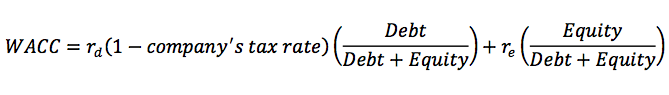

You simply can't go to a corporate finance or asset management interview without knowing this formula. It is basic and fundamental. You might also like: Where can you get the cost debt used to calculate WACC? What is the Capital Asset Pricing Model, CAPM?  by Girl Banker Listen to the iTunes podcast instead. The cost of debt is very easy to calculate if the company has debt liabilities on its balance sheet. Because interest is tax deductible (in most countries) this tax benefit has to be subtracted from the cost of debt. Most companies do hold debt on their balance sheet so this is by far the most common route. If you were unfortunate enough to find yourself with a company that had completely no debt on its balance sheet, the next best route would be to use a proxy. A reasonable proxy would be the cost of debt of very similar companies. Hopefully you would have a sufficient sample of similar companies that have issued debt instruments recently from which to calculate such a proxy. If no similar companies were available then an assumption would have to be made in collaboration with your debt syndicate team based on the current economic environment. However, this would likely lead to your using a higher cost of debt than is necessary to keep your numbers realistic. It's not the best way of coming up with a cost of debt number but it would be the best you could do in the circumstances. As a reminder, this is the formula for WACC, the Weighted Average Cost of Capital: Where r(d) is the average cost of debt and r(e) is the cost of equity.

You might also like: What is WACC, the Weighted Average Cost of Capital? What is the Capital Asset Pricing Model, CAPM?  by Girl Banker Listen to the iTunes podcast instead. Totally swamped? Don’t know how to cope with your current work load never mind making investment bank internship applications? Well, as important as getting top grades is, getting a job is just as important. In fact, I recently had a similar work load problem. I signed up to do an online course on building informational apps and I simply couldn’t fit it in. The solution? An hour a day! As busy as I am, I decided that I could dedicate an hour every day to the cause as it was important enough. By sticking to that commitment I have managed to finish the course within two weeks. You can do the same for your job applications. You don’t have to do everything in one go. Split the investment banking application process into one-hour batches and spread it over the next three or four weeks. I personally wouldn’t wait until the Christmas holidays to make applications because some banks are reading applications as they come through and not only inviting people for interviews but making internship offers. This means the pool of internships available is shrinking every week. Here is how you can organise yourself: 1. The first application is the most crucial, it sets the trend for the rest. I wouldn’t submit an application for the first week to ten days. Week one is ‘research week’. You need to figure out:

At this point, I am of course going to do like any self-respecting author and plug my book, To Become an Investment Banker (spare yourself the reading and get the audiobook). It contains all the above and much more! The audio book is just over 9 hours long. 2. Research done, it’s time to log onto investment bank sites and draft your first answers. In order to get access to the questions, you’ll need to enter some personal details into an online application form. Enter whatever details you need to give to gain access to the application form, then copy and paste the questions into a word processor. Do this for two or three banks. 3. Draft some answers. Read through your answers. Ensure all claims are validated with a relevant example. 4. Get an independent opinion on your application form. If you can’t afford professional help get a friend to do it. If your friend’s feedback is very brief or overly complimentary get another friend to check your answers. Keep in mind that friends can find it hard to give constructive feedback. I had one guy send me one if his friend’s cover letters and ask what I thought of it. I thought it was rubbish, he did too but he didn’t know how to tell his friend so he just left it at that! 5. When you are happy with one application, send it off. Getting happy with the first application will probably take 5 to 6 one-hour slots. 6. Move on to application two. This will take 3 to 4 one-hour slots. Once you have the hang of it and there is sufficient overlap between questions you will get it done even faster. An hour a day is all you need to get all your applications done in 3 to 4 weeks. Get on with it!  by Girl Banker Listen to the iTunes podcast instead. I get asked a question related to this topic every single week! The answer is yes but even from target universities they are looking for the best of the best. First off, let's define what we mean by "target universities": Every major investment bank has an annual hiring cycle. The human resource department has a limited budget to spend on recruitment and as such will choose a handful of universities to focus their recruitment efforts on. These form their "target universities". As a target university, that institution will get:

Students from target universities do not get their applications looked at in preference to students from non-target universities. That said, because of the extra effort in recruiting from a specific campus the investment bank will receive more applications from their target universities. Fewer students from non-target universities have the relevant information and as such will apply in smaller numbers. The top investment banks will have the very top universities on their target list. Mid-ranking investment banks are realistic and will include mid-ranking universities on their target list because they have lower potential to attract students from top institutions. Here are three example emails that I have received in relation to recruitment from non-targets: Email 1 - a high potential candidate from a non-targetHeather, Thank you very much for your time! I recently purchased your book and I absolutely love it; it was the exact kind of information I was looking for! With that being said, I have recently become interested in pursuing a career in investment banking. However, I am worried that my current/past experience will prevent this from happening. Without sparing too much of your time, I went to a mediocre school for my undergraduate degree (University of [Blah], USA). I majored in engineering and economics, the former being my original career goal and the latter a result of going back to school because of the economic crisis. My GPA was 3.0 due to a lack of effort on my part. I did not participate in many clubs or extracurriculars in school, which of course I regret now. Anyways, I have worked in both fields since graduating in 2010, and have concluded that engineering just isn't for me. So I am considering changing careers into finance, specifically investment banking. FYI, the extent of my experience in finance was getting FINRA Series 6 & 63 licensed and working at a company that manages retirement plan accounts. I would deal with all account information, withdrawal requests, deferral changes, plan inquiries, trade requests, etc. I am concerned that my school, my mediocre GPA and my lack of experience will completely prevent me from getting any kind of job in this field. I view my engineering degree as an advantage in the sense that it shows technical and time/project management expertise, but the more I read about IB the more I am realizing that I would be competing with people that have gone to top tier schools, gotten excellent grades, participated in all relevant social groups and school orgs, and hooked an internship at a big bank while in school. How am I supposed to compete with this?! Is there any hope? I know you offer consulting, and I was hoping such a simple question wouldn't fall under that. I guess I am just looking for an answer to this question from an IB so that I know how to move forward or at the very least don't waste my time trying! Thank you again! Best Regards, [American Guy] Email 2 - a low potential candidate from a non-targethi I am emailing you regarding the coaching sessions you give to students who trying to get a foot in to the IB industry. i would like put a strong point forward i know the competition is tough out there in this disastrous period we are seeing in the economy but for stuudents who do not come from the top target universities, dont stand a chance in this industry espcially if we are looking for roles in sales and trading its more about the univeristy reputation these days to those applying to bulge bracket banks as i have noticed from yourself who went to cambridge all i see is all top universities which is when i look at the people who have been offerd interhsips. Its very unlikey to catch a non target school who gained a internship. The reason i say this is that i am extremely passionate about working in the financial markets as i am stuyding my degree in investment banking banking and finance at a school who specifically teach you the detail knowledge of the financial markets ,but i am being held back by the reputation of the school as its not a target and the HR don't think these days will invite students from a non target school for an interview i am currently going into my third year so what do i do ? how can you help me ? i know what i have just stated is quite negative but i think if i am so passionate i should given a chance thank you h [UK Student] Email 3 - a 15 yr old with major Ivy League potentialHi Ms. Katsonga, my name is [ ]. I am a 15 year old independent equities and bond trader. I am intrigued by investment banking. I am ordering your book on Amazon and would like to ask a few extra tips from you directly. What degree do you recommend to be well prepared for banking? Will it help a great deal in my application process the fact that I have a trading track record since I was 15 with high returns? Or with your experience is that easy to come across by and not something investment banks value. When should I do my CFA? After my degree, during work? And what else stands out on a resume for investment banks? Your book might answer these already when I receive it but it's not always the same as speaking directly to a person. I really appreciate your expertise. I really love your videos because they are very concise and 'to the point'. I would extremely appreciate and value a response. Sincerely, [Boy in Canada] EMAIL ANALYSISI thought this sample of three emails is adequate to get my point across.

Part of the reason that students from the best universities stand a better chance is that they are taught or they find out for themselves "the rules of the game"; in addition to going to a top university they: a) Get coaching (I did too) b) They seek out services for mock interviews c) They make sure their application is written in great English with no grammatical errors and d) They do A LOT of research. For instance, let's take a look at email 2 - it's full of grammar errors and even has some spelling errors. There was no subject on the email; it didn't address me directly and it was not signed off properly etc. Investment bank recruiters are VERY critical and they would reject an application for as small a transgression as not capitalising the "i"s. Do you see where I am going? Now look at email 1: it's very well written, has a great structure, addresses me correctly and conveys the keenness of the writer perfectly. Similarly, email 3 is extremely polite and one can immediately tell the writer is a high achiever. The young man in email 3 actually thought there are many people his age dabbling in share dealing. I was so intrigued that I wrote back to find out more about him. He's the type of guy you really want to help get in front of the right people and that is the crux of getting a job in an investment bank: you need to portray yourself in a way that makes people immediately want to help you! Students from target universities do not get in just because of the institution they are from. If you are serious about getting into an investment bank you need to be at the top of your game.  by Girl Banker Listen to the iTunes podcast instead. This is the most comprehensive list of tips for writing a resume or CV on the internet yet! Ensuring that your resume is very well crafted and answers the needs of the recruiter will increase your chances of getting a job interview immeasurably. A good resume/CV is the first step to landing that job you want. Our tips: 1. Don’t write “Curriculum Vitae” or “Resume” at the top This simply isn’t the done thing anymore; it should be pretty obvious what it is. 2. Your name should come at the top This is the current standard. It makes it easier for recruiters to sort out their pile of applications. 3. No silly email addresses So, SexySuzy@hotmail.com or bootylish@yahoo.com felt like a cool email to have when you were 16. It unfortunately does not make you look professional or serious. Create a neutral email for your resume/CV – nothing funny, saucy or rude is ideal. 4. Don’t include a title with your name Your sex is not relevant. If you have a name like Sam or Alex, there is no need to write your title so that the employer knows whether you are male or female. In fact, having a gender neutral name might be an advantage. On average, the recruiter will assume you are male and as the job market currently tends to favour men over women, keeping it vague is probably a good thing. 5. The only necessary personal information: email, phone number, mailing address Everything else does not matter and should therefore not be included. Double check, are all the digits of your phone number there? It's an easy mistake to make! 6. Don’t include marital status or sexual orientation Whether you are single, married or divorced, gay or straight is completely irrelevant to the job; don’t include any of these personal details. Importantly, giving too much personal information opens you up for discrimination. 7. Don’t include your religion It doesn’t add to your value as a potential hire. 8. Don’t include your political affiliation It doesn’t add to your value as a potential hire. 9. Don’t include any salary information That said, using the correct words and appearing mature will signal the sort of pay packet you are after. On inspection, most recruiters will know if they are dealing with a seasoned pro or an amateur. 10. Avoid age discrimination It used to be common to include your date of birth on your resume/CV but by law that is no longer necessary in many developed countries. Your age doesn’t impact your ability to do most jobs so don’t include it. 11. Font: use Arial size 9 or 10 Arial is clean cut and looks very professional. If you really want to get it all on one page and Arial is taking up too much space, use Arial Narrow. 12. Length: one page, ideally Most people have a very short attention span so the shorter it is, the more likely that the recruiter will get through the whole resume/CV. Two pages is okay but even then, get the most critical job-grabbing information on page one. 13. How far back should you go? No more than 15 years, generally As you gain work and life experience, you’ll need to start deleting some experiences because they simply don’t matter anymore. For instance, my CV when I finished high school had some positions of responsibility: Head of House, Captain of This, Captain of That and I have deleted all of that now. It’s not relevant and has been superseded by my university and more recent experiences. 14. Use bullet points Bullet points give structure to a resume/CV, they make it more punchy and much easier for the recruiter to read. 15. Don’t use narrative Don’t use full sentences or write like you are telling a story. You can do that on your cover letter. 16. Don’t use personal pronouns – I, he, she, it, we, they, you Get straight to the point. “I closed the largest sale of the year” is too long, just say “Closed largest sale in 2012” 17. No borders Generally, a professional resume/CV does not have a border. If President Obama or David Cameron had to write a resume/CV do you see them having borders on it? For some reason, I cannot. Even from the very outset, you want your resume/CV to have the air of a Statesman – clean, confident, professional, to the point. 18. Don’t try to be too different, no fancy stuff Take it from someone that’s had to recruit before. Above and beyond looking clear and smart, there is nothing more annoying than someone who tries to stand out by a) adding graphics to their resume/CV or b) presenting the information in a totally different way to the standard. If you have a pile of 50+ resumes/CVs to get through (and a lot of recruiters nowadays have many more), it is a lot easier to get the work done when people follow the usual order of things. Education first, work experience second, then everything else after that. When I want to hire, I just want someone that can do the job and having a cool resume/CV isn’t going to differentiate you. If anything, some might assume you are trying to compensate for a lack of something. 19. Format matters Some resumes/CVs look downright shoddy. A recruiter who has a large pile of resumes/CVs to get through will not waste their time on someone that couldn’t bother to neaten their resume/CV up. We have free resume and CV templates to get you started. 20. Show dates clearly Place dates either on the left or the right so it’s easy to follow your education and work experience path. Merging it all together with your bullet points is a) messy and b) can suggest you are trying to hide career gaps. 21. Date formats should be consistent Generally, if I just have a year, I write the full year. If I have months and the year, I shorten the year because the resume/CV starts looking clogged up. Good format for year: 2012 Bad format for year: ‘12 Good format for month and year: Sep-12 Bad format for month and year: September 2012 (it takes up too much space) 22. No pictures Unless the employer asks for it, you don’t need to have a photograph of yourself on your resume/CV. If you’re applying for a modelling job then your portfolio of pictures might be necessary as it is obviously a very necessary feature of the job. 23. General rule: most recent information goes first Put the most recent education and the most recent work experience first. So, under education, university comes first and then secondary or high school information. Under work experience, the most recent work experience is put first. 24. Relevance rule: most job-relevant information goes first If the most recent work experience is not the most relevant, place the most relevant work experience first. 25. Use the correct spelling Applying for a job in the UK? Then use British English. Applying for a job in the USA? Then use American English. By the way, to the British it’s a CV; to Americans it’s a resume. 26. No typos please It will definitely reduce your chances of getting a job. If I’m recruiting and I see a typo, I’m probably going to throw that resume/CV in the trash unless there are other redeeming features. 27. Don’t use text language, jargon, acronyms or slang This is a big no-no. Text language is essentially a typo. It should not feature anywhere on your resume/CV. Jargon will make it difficult for the recruiter to understand your background. Remember, resumes/CVs normally get filtered by Human Resources (HR) before they are passed on to the teams that need to hire. HR might not be familiar with some jargon. Same applies for acronyms; unless they are accepted acronyms like USA, UK etc. an acronym is essentially jargon. You should spell out your acronym first (like HR in the previous sentence) if you intend to use it. Slang is simply not professional, do not use slang. 28. Use a descriptive title Especially if you are applying as an experienced hire, under education and work experience, make sure the job titles are very specific and that they sell you. Specific titles allow the recruiter to very quickly decide if you have the necessary qualifications and experiences for the job. Bad title: Analyst at Bank X Good title: Analyst on Energy Team in Investment Banking Division at Bank X 29. List all the positions you held in one firm separately If you’ve been with one company for a long time, it’s likely that your title and/or job function has changed over the years. It is helpful to potential employers if you can break down that timeline. Segmenting the information gives an employer useful insight into the nature of your experience. 30. Lacking in work experience? Focus on skills and qualities. When you are just starting out, you may well not have any work experience. However, if you have time, get some work experience. Even unpaid work e.g. volunteering at a charity shop or at an Olympics or other event is great to have on your resume/CV. 31. Don’t list qualities It doesn’t matter if you say you’re a great team player or have fantastic communication or leadership skills unless you can back that up.

32. Include Positions of Responsibility Positions of responsibility e.g. being Head Girl, Head of House or Captain reveal that you have experience in being a leader and managing people. Indeed, they might also reveal that your are popular and personable – more often than not, to be Head Girl, Head Boy or Head of House teachers or the whole student body have to vote for you. If you’re still in school or university and there’s time, try to attain a position of responsibility in some club or society. 33. Include Achievements Achievements reveal very different information to Positions of Responsibility, they show you are a goal-setter and an achiever in either sport, the arts or academics. This in turn reveals you’re a hard-worker, persevering and have initiative. Getting an award for something is not usually easy, it requires some amount of grit and determination. 34. Be careful about including interests. Don’t include hobbies. Some interests open you up to being judged harshly. Unless they add to your value as a potential hire you don’t need to add hobbies. At times including a hobby may relay useful insight, for instance, if you’re applying for a role where a lot of reading will be required e.g. reading legal or other documents, then mentioning that you’re a prolific reader and that you can read a 300-paged book in one afternoon is of value. 35. Look decisive, don’t tarnish your loyalty card Employers want to hire someone that will stay for a while. If your resume/CV shows that you chop and change jobs very regularly, this will act against you. It will show one or more of the following:

36. Throw in some stats Numbers help to further credentialize you. If you’re applying for a sales position add examples of sales targets you have reached or exceeded. Example: Emerging Market FX Sales, Bank X

37. Don’t include reasons for why you left your old job It’s not necessary on a resume/CV as it doesn’t add value to why you might be a good candidate for the job. Of course, it is likely to come up in interviews so make sure you have a good response to the question. 38. Don’t say anything negative There is no space on a resume/CV for complaints or criticisms of previous employers. If you didn’t like a certain job or activity that you took part in, don’t say that. Recruiters don’t like complainers or problem-makers. 39. Don’t lie, don’t exaggerate Your employer will find out when you start work if you exaggerated anything or a background check might bring out inconsistencies. You could lose your job, or end up in court if particularly egregious. It’s not worth it, don’t do it. 40. Have different resumes for different roles If you are applying for exactly the same type of job in different companies then the same resume/CV will suffice. However, if you are making applications based on different job specs then you need to customise your resume/CV. 41. Before you send it off, match your resume/CV against the job specification Ensure that your resume/CV includes as much as possible regarding what the employer has asked for. That said, a major point to keep in mind: you don’t need to have 100% of what has been requested. Statistics show that men frequently apply for a job even when they only partly match the person specification. Women usually only make the application when they have everything. I say, be a man! 42. Check it twice then get a fresh pair of eyes to look over it again This is related to the point on typos. When you have been working on your resume/CV for a long time you might fail to see inconsistencies that a fresh pair of eyes will pick up immediately. Get a professional resume writer to review your resume and increase your chances of getting a job interview. 43. Key words matter Nowadays recruiters including head hunters frequently use searchable databases to find a candidate. This is also true on LinkedIn. When I am looking for someone I will type “Head of Diversity Recruiting at Company X” or “Marketing Expert, New York” etc. Make sure your resume/CV uses the correct keywords for the job you are looking for, so you are visible on these searches. 44. Mention any prominent industry specialists that you’ve worked with This will help to credentialize you. Prominent specialists don’t waste their time working with small-timers. Having had access to and worked with people of this calibre adds credibility to your profile. 45. No need for references It is more common for people to just write “References available on request”. Some people think this is daft because that’s stating the obvious. However, I would say include this line if there’s space. It doesn’t do you any harm. 46. Update your resume/CV and your LinkedIn profile regularly Ensure you have an updated resume/CV and profile on LinkedIn so you’re ready to take advantage of your next opportunity. We live in a fast paced world; your next job offer is always around the corner. Head hunters are constantly scanning people’s profiles on LinkedIn to fill new positions. Gone are the days when people sat in the same job for 30 to 40 years at a time. 47. Print your resume/CV on a high-quality printer This ensures it looks attractive and professional. 48. Print your resume/CV on high-quality textured paper This adds to the look of professionalism. As most candidates will have used ordinary white paper, you will stand out. 49. Email your resume/CV in PDF format PDF looks cleaner and can be viewed in the same way on any computer. If, for instance, your resume/CV is written in Microsoft Word, sending it in that format means:

50. Consider getting professional help Especially during recessionary times, employers are inundated with resumes/CVs for available positions. Getting a professional to look at your resume/CV and mark it up is a worthy investment. It’s especially useful if you’re new to the job market. Sent your resume out for many positions and heard nothing back? Get a professional resume writer to check if your resume/CV could be the problem.  by Girl Banker Listen to the iTunes podcast instead. Your résumé/CV should summarise your educational background, previous work experience and any relevant positions of responsibility and achievements that qualify you for the job. Both the content and the format matter. A well formatted résumé/CV will show that you are organised and pay attention to detail. A shoddily presented one will do exactly the opposite. You won’t get the job. The vast majority of investment bank applications are made through the bank’s standardized online form. Despite this, you should keep an updated PDF version of your résumé/CV so that you’re ready to send it to prospective employers when requested.  When might you need to send your résumé/CV out? 1. Let’s say you go to a networking event, you impress a recruiter and they ask for it, you don’t want to waste time updating an old one. If it’s ready, you’ll be able to respond much more promptly. If you have a few copies on you, give them one and ask for an email address to which you can send the soft copy. 2. If you cold call any investment bankers, asking to follow up with a résumé/CV is a great way to keep the conversation going. You want to be able to send it as soon as you get off the phone. If you managed to generate any interest, that interest will be at its peak immediately after the call. Therefore, if you send your résumé/CV promptly, it’s more likely it will be 'actioned'.  What should you include to make those investment bankers call you up? Educational Background – Grades and Marks If you’re just coming out of university, this section has a lot of weight. The weight attached to your education falls with every year of work experience. The top achievers frequently include marks achieved on various papers. Not including your marks doesn’t mean you haven’t got great marks, it could just mean you don’t know what they are. For instance, when I got my GCSE and A level results, I was given my grades but not the underlying marks or position – I never thought to ask. Importantly, a person that gets 70% at a top university may in reality rank better than or equal to someone that gets 80% at a mid to low tier institution. At Cambridge, I was told that they try to maintain the same standards as they did in the days of John Maynard Keynes. So when they are marking papers they’re marked based on the very best scholars that have ever passed through the university not just that years intake. Some universities aren’t so stringent. Work experience Any experience in the investment banking sector should be ranked first. Generally, experts advise putting the most recent work experience first but this is not always the best advice. At times, it’s better to put the most relevant work experience first whether or not it’s the most recent. Positions of Responsibility If you've been Captain of a sporting team, drama or some other extracurricular activity you would normally put it under a separate section. Positions of responsibility show you have leadership skills. Other Skills and Interests If you put anything strange down, you will be judged. In this section, include and IT skills, language skills and anything else that might be relevant. Ideally, this should all fit one page; two pages is max. Good luck! GB |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed